washington state long term care tax opt out rules

Long-term care insurance companies approved to sell in Washington state. Yes it is possible to opt out but employees should act quickly to preserve this ability.

Washington State Long Term Care Tax Avier Wealth Advisors

For those who got in before the site crashed minutes after it opened I hear it was easy.

. Under Washington state law accelerated benefits cannot be sold or advertised as LTC insurance. What qualifies as long-term care insurance. November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy.

Get a Free Quote. That means youll never have access to the WA Cares Fund benefit which is currently 36500 We have asked the state to clarify if that also means the process of opting out is for life if yearly attestation or proof will be required and if the state can change the rules in the future. You will not need to submit proof of coverage when applying.

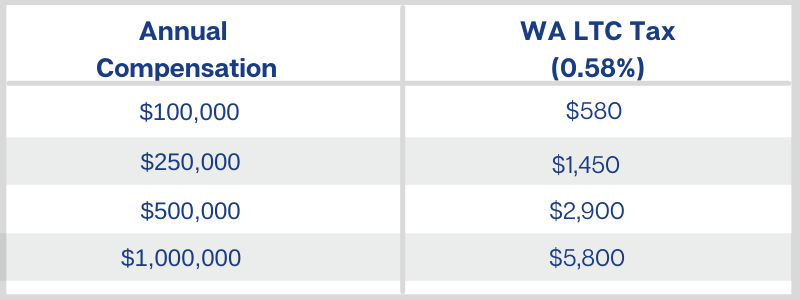

1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. The initial premium rate is fifty-eight hundredths of 1 of the individuals wages or 058 RCW 50B04070. You will need to attest that you have purchased a private long-term care insurance policy before November 1 2021.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months. Employees can opt out of the WA Cares Fund only if they secure their own private long-term care insurance by Nov.

A tribe that opts in may opt out at any time for any reason it deems necessary. It can include home health care adult day care nursing home care and group living facility care. To avoid long-term care tax Washington residents must opt out now July 13 2021 Washington residents must enroll in private insurance by Nov.

First to opt out you need private qualifying long term care coverage in force before November 1 2021. The WA Cares Fund which provides eligible adults 36500 for long-term care costs will be funded by a new payroll tax. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for an exemption from the program.

How do I file an exemption to opt out. I have not had success. Can employees opt out.

The OIC determined accelerated benefit riders and critical illness riders do not qualify as LTC insurance products. The employee must provide proof of their ESD exemption to their employer before the employer can waive. Starting January 1 2022 all employees in Washington unless qualified and approved for an exemption from the.

Opting back in is not an option provided in current law. SHB 1323 provides a pathway for federally recognized Washington tribes to elect coverage into the LTSS program. Workers who live out of state and work in Washington military spouses workers on non-immigrant visas and certain veterans with disabilities will be able to opt out of the program if they choose.

Employers will not be required to collect the 58 payroll tax until July 1 2023. Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of Washington starting today.

The statute provides that an employee whois age 18 or older and who attests that they have long-term care insurance may apply to ESD for an exemption from the LTC premium assessment. Under proposed rules draft WAC 192-905-005 the alternative long. Washington state long term care tax opt out rules Monday March 21 2022 Edit What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management.

Now workers with private long-term care insurance in place by the end of October 2021 can apply to be exempted from. In addition the law was updated so individuals born before January 1 1968 who have not paid premiums for the. As state agencies continue to work on the implementation rules there is high interest in the program and the payroll tax exemption process.

Employers will refund any premiums collected in 2022 so far. That tax which goes. Washingtons new long-term care program the WA Cares Fund marches towards the effective date of the payroll tax.

If a WA resident earns less than 100000 a year or does not plan to earn more than 100000 a year in their career it is not worth opting out of the long-term care payroll tax. But according to the Association for Washington Business an amendment passed this year that removed much of that flexibility. Long-term care insurance helps with many medical personal and social services for people with prolonged illnesses or disabilities.

Individuals who have private long-term care insurance may opt-out. Right now the WA Cares Fund website says of opting out Exemptions are for life. WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington.

1 2021 and they apply for. Workers will begin contributing to the fund in July 2023. Consider this a private option for long-term care insurance.

This is mainly because their benefits are paid to the insured without requiring the funds to be used for long-term care services. If a WA resident is nearing retirement it is not worth opting out of the long-term care payroll tax. The bill requires the department to adopt rules to implement these provisions.

When the bill passed in 2019 it contained an opt-out provision and integrated it with private long-term care insurance. The payroll tax applies to active W-2 employees only. Washington State is accepting exemption applications between October 1 2021-December 31 2022.

This is a permanent opt-out once out you cannot opt back in. This amounts to 580 annually for a W2 income of 100000. 1 to escape new payroll tax.

Under current rules in order to opt-out of the payroll tax Washington state residents will need to secure LTC Insurance coverage by November 1st of 2021. 1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit.

Washington State Long Term Care Tax Avier Wealth Advisors

How To Convert A C Corporation To An S Corporation Gudorf Law

Advice Regarding The Washington State Long Term Care Law Financial Plan Inc

Medicaid Supports For Family Caregivers The National Academy For State Health Policy

S Corporations Tax Deductions For Ltci The Long Term Care Guy

Washington State Long Term Care Tax Avier Wealth Advisors

Water Cultural Diversity And Global Environmental Change Emerging Trends Sustainable Futures

It S Time To Rethink Washington S Long Term Care Law Brunell Kirkland Reporter

It Is Time To Mandate Covid 19 Vaccines In Long Term Care Facilities

Long Term Care Legislation Delayed In Washington State

Overview Of Washington State Tax Law Changes Beginning January 1 2022 Neither Definitive Lasher Holzapfel Sperry Ebberson Pllc Jdsupra

It S Time To Rethink Washington S Long Term Care Law Brunell Kirkland Reporter

%2010.png)